What can we find for you?

If you are currently a Metro member, please select “Current Member Application” and log into our online banking platform.

If you are a non-member, please select “New Member Application” to apply.

A home equity line of credit (HELOC) allows you to borrow money against the portion of your home that you own (equity) - the amount your home is currently valued at, minus the amount you have left on your mortgage and other existing liens. At Metro Credit Union, we offer multiple HELOC options for up to 90% of the equity of your home.

You can use a HELOC for a dream wedding, home renovation, debt consolidation, emergency expenses, education costs, major purchases, and more - the choice is yours! With a flexible credit line, you can access funds when you need them, making a home equity line of credit a great solution for ongoing or unexpected financial needs.

Once approved, your HELOC works like a revolving line of credit. You can borrow from your credit line when you want for as much as you want, up to your limit, and pay your balance down monthly, with no penalty for early payoff. As you make payments towards your outstanding balance, your available credit is replenished allowing you to borrow up to the limit when needed.

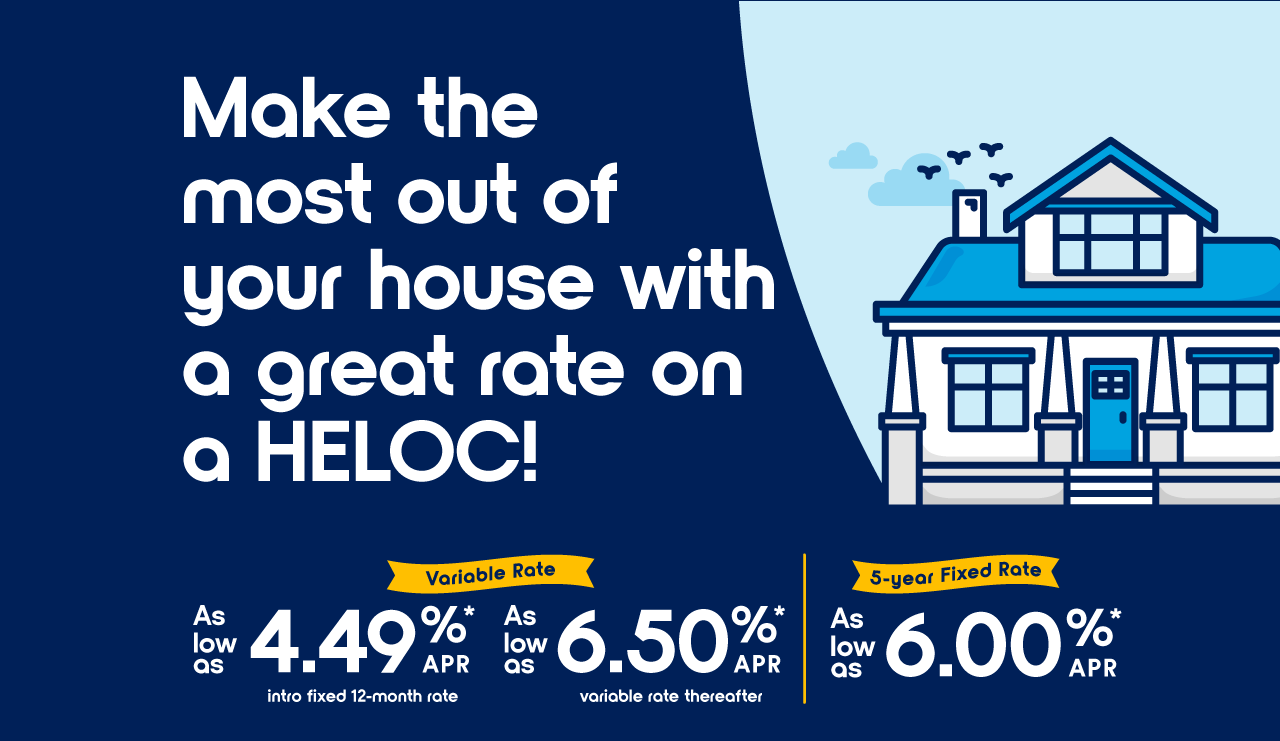

HELOCs are 15-year loans, with draw periods ranging from 5-10 years, followed by a repayment period. This setup gives you ample time to access and repay your funds, offering a manageable way to finance larger expenses. At Metro Credit Union, we offer two types of HELOCs: Fixed Rate and Variable Rate. In addition to a quick application process and fast approval turnaround, we offer low closing costs and easy access to funds through online banking.

A Fixed Rate HELOC allows you to lock in an interest rate for the duration of your credit line. While your monthly payments may vary based on your outstanding balance, the interest rate remains the same throughout the draw period. This option provides stability and protection against rising interest rates.

Fixed rate HELOCs are ideal for those who:

A Variable Rate HELOC has no locked rates, meaning the interest rate fluctuates based on market conditions. This means your monthly payments may increase or decrease depending on interest rate changes. Metro’s variable rate HELOC has a 12-month introductory rate, after which the rate becomes variable.

A variable rate HELOC may be a good fit if you:

Metro Credit Union is a trusted HELOC lender in Omaha, offering affordable home equity loan solutions with competitive rates, fast approvals, and personalized service. Whether you’re looking to finance home improvements, consolidate debt, or cover major expenses, our home equity line of credit options provide the flexibility and financial support you need.

Contact us today to learn more about HELOC loan options and start leveraging your home’s equity!

| Details | Fixed HELOC | Variable HELOC |

|---|---|---|

| Maximum Loan-to-Value | 90% | 90% |

| Minimum Required Credit Limit | $10,000 | $10,000 |

| Term | 15 years | 15 years |

| Draw Period | up to 10 years | 10 years |

| Interest Rate | Fixed rate during draw period Variable rate after draw period | Variable rate |

*Calculators are for general education only, not representative of Metro Credit Union offerings. Results are estimates based on user input and are not financial advice or guarantees. Consult a Metro Credit Union advisor for personalized advice. Metro Credit Union disclaims accuracy and liability for calculator use.

Jeff Hudkins

Mortgage Sales Manager

MLO Identifier: 776795

Bobby Miles

Mortgage Loan Originator

MLO Identifier: 964470

Phone: 402-552-7179

Email: bobbym@metrofcu.org

Vanessa Fuentes

Mortgage Loan Originator

MLO Identifier: 1536151

Phone: 402-552-7138

Email: vanessaf@metrofcu.org

Hablo Español

Zach Novak

Mortgage Loan Originator

MLO Identifier: 1705911

Phone: 402-552-7145

Email: zachn@metrofcu.org

I've had a great experience that's allowed me to establish credit with my first auto loan. Thank you Metro for giving me this opportunity.Jessica A.

I joined in 1990 & always receive great service. Technology has evolved for increased convenience & loan rates are great!Ann T.

I have been with Metro Credit Union since 1996. I wouldn't change to any other bank. Very friendly people and their service is outstanding.Tammy F.

They make banking easy. The mobile app allows quick access to activity going on in my account, and their tellers are great with ensuring the security of my account.Katherine V.

I have had multiple loans with Metro Credit Union, and they have stood beside me throughout the six years that I have been banking with themDuane T.

I have been a member of Metro Credit Union for 40 years. I have gotten car loans and other loans. Some of my children are banking there as well. Friendly and knowledgeable personnel at all locations. Love my credit union!Louise G.

I've done business with Metro for 7 years. Every branch is friendly and willing to do business to suit my needs. Referred to many friends.Brian G.

I love banking with Metro! I’ve never had an issue, whenever I have questions I write to them on the mobile app & they always answer quickly :)K.W.

It’s always a great experience at Metro Credit Union!Randy J.

Tellers are very friendly and able to answer questions and assist in timely manner. Also they have really good coffee for customers.Wendylyn M.

I visited the Emmet street location today and was met with nothing short of outstanding service from the folks working there. Special thanks to Justin, went above and beyond today. Kudos to you all!!Mohammed H.