From medical improvements to better computers and new apps, technology has become integrated into what seems like all aspects of our lives and has improved our quality of life. The use of technology in banking is beneficial for managing personal finances by tracking your spending whether through spending tracker apps, budgeting spreadsheets, or online banking tools. Having up-to-date information allows you to make informed decisions based on accurate personal financial information.

Benefits of Digital Banking

Convenience

Digital banking services are convenient and can enhance your finances to assist you with:

- Create a monthly budget so you can stick to your allocated plan.

- Paying your bills on time.

- Growing your savings so you can have an emergency fund or save for a vacation.

- Applying online for a new account, auto loan, mortgage, and more.

Simplified Money Management

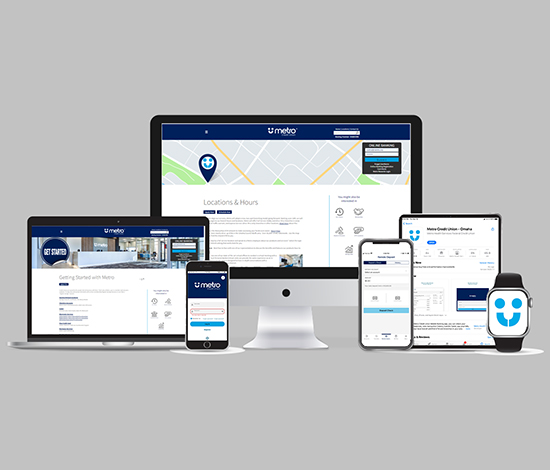

Between Metro’s online banking and mobile app, you can access your account(s) anytime, anywhere, saving you time and simplifying your money management. You can register for Metro’s Online Banking Access to experience the benefits of digital banking to check balances, pay bills, set up payments, apply for loans, check rates, and more. Be sure to download Metro’s mobile app to have your banking information at your fingertips and you can set up text alerts and use Remote Deposit Capture where you can deposit checks from the comfort of your home.

Security

Financial institutions now use the best security protocols to help keep your transactions secure. Several methods are incorporated to keep your information safe, including:

- Usernames and Passwords

- Multi-Factor Authentication

- Security layers that help in preventing outsiders from attacking

- Encryption processes that keeps your data hidden during electronic transit

- Automatic sign off if your online session is idle for too long

Metro Credit Union offers online alerts and notifications to all members through our online banking and mobile app. Alerts and notifications can be tailored to you and your needs. Select between the different delivery methods (SMS, Email, or Push) and the different alerts, all from your phone or computer.

Be sure to check out these additional electronic services:

- Take advantage of Apple Pay and Google Pay and add your Metro credit card to those services.

- Electronic Statements – Receive your monthly statement electronically. Faster, safer, convenient.

- Bill Payer – Set up your monthly bills to be paid electronically.

- FICO® Score – Click here in online banking or after you log in, select the More option in the menu and then you'll select FICO® score. Read more about credit scores.

When it comes to managing personal finances and using technology, it is important to be aware of online financial scams. Avoid clicking popups, opening attachments, or doing downloads to your computer. Read more about financial scams continuing to rise. You can also take a free Save and Succeed course about protecting yourself from identity theft and scams.

Metro Credit Union in Omaha, NE

If you prefer doing business in-person, Metro offers Full Service (lobby and drive-thru) branches in areas where foot-traffic warrants, and Express Service (drive-thru only) branches in other locations. We have online appointment scheduling if you want to speak to a Metro employee about products and services. Select the type of appointment setting that works best for you.

Metro Credit Union is Your Local Advantage for auto loans, HELOCs, Credit Cards and checking, and more!